salt tax deduction wikipedia

After computing their adjusted. What is the SALT Deduction Taxpayers in the United States were granted a range of tax preferences from the federal government.

Two Lawmakers Debate Reinstating Salt Deduction Youtube

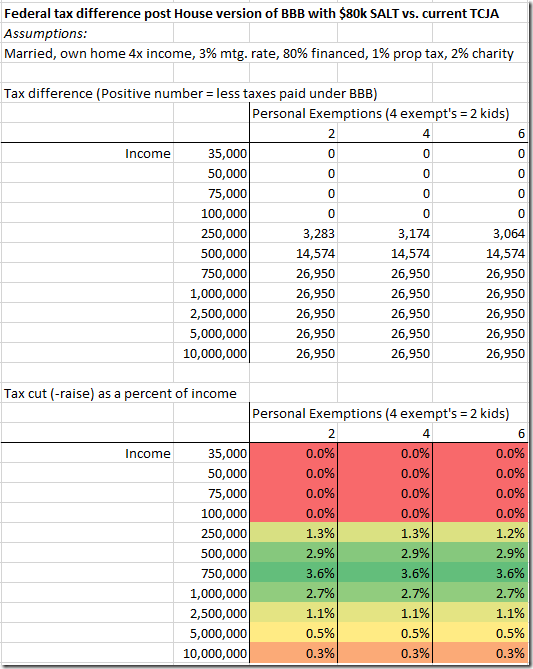

1 day agoThree House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

. The lawmakers simultaneously introduced legislation that would eliminate the 10000 SALT cap on federal tax returns that was imposed as part of. Since the SALT cap was put into place however very high earners have seen a sharp reduction in the deduction as a percent of AGI from 77 percent in 2016 for those earning over 500000 to 071 percent in 2018. In 2016 taxpayers with AGIs between 0 and 24999 claimed in.

The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and. If lawmakers decide to preserve the tax break they might have.

That limit applies to all the state and local. The salt tax originated in China in 300BC and became the main source of financing the Great Wall As a result of the successful profitability of the Salt Tax it began filtering through the rulings of nations across the world France Spain Russia. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut.

In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction. Only 66 percent went to taxpayers with incomes below 50000. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

Most taxpayers are allowed a choice between the itemized deductions and the standard deduction. The rich especially the very rich. Riot against the new salt tax 1648 in Moscow Ernst Lissner.

From Wikipedia the free encyclopedia. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to. The anti-fiscal riot is a form of popular protest very common during the Ancien Régime the bourgeois revolutions and the 19th century characterized by the use of direct collective action to.

Recap of the SALT Cap Workaround. To help pay for that increase SALT deductions were capped at 10 000 per year consisting of property taxes. The Salt Tax Revolt took place in the Spanish province of Biscay Vizcaya between 1631 and 1634 and was rooted in an economic conflict concerning the price and ownership of saltIt consisted of a series of violent incidents in opposition to Philip IVs taxation policy and the rebellion quickly evolved into a broader social protest against economic inequalities.

In 2016 77 percent of the benefit of the SALT deduction accrued to those with incomes above 100000. Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses particularly those incurred to produce additional income. Doing away with the SALT deduction is projected to save the government between 13 trillion and 18 trillion over the next decade.

The Tax Policy Center says that the SALT deduction provides an indirect federal subsidy to state and local governments by decreasing the net cost of nonfederal taxes to those who pay them. The value of the SALT deduction as a percentage of adjusted gross income AGI increases with a taxpayers income. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax rates including a reduction in the top rate.

The SALT deduction ranks eighth on a list of the top federal tax expenditures from 2013-2017Several other tax expenditures are costlier including reduced rates on dividends and long-term capital gains 2 net exclusion of pension contributions and earnings 3 and the. The federal tax reform law passed on Dec. The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or sales taxes but not both.

A salt tax refers to the direct taxation of salt usually levied proportionately to the volume of salt purchased. The Revenue Act of 1913 which introduced the federal income tax states that all national state county school and municipal taxes paid within the year not including those assessed against local benefits can be deducted. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Under United States tax law itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income and is claimable in place of a standard deduction if available. The taxation of salt dates as far back as 300BC as salt has been a valuable good used for gifts and religious offerings since 6050BC.

Jump to navigation Jump to search. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. With roughly 20 states that have a PTET election and over half of these states enacting such.

Repealing the SALT deduction cap and raising the top tax rate to 396 percent would reduce federal revenue by 532 billion over the next 10 years. In the past year a multitude of states enacted pass-through entity tax PTET elections in response to the 10000 state and local tax SALT deduction limitation that the Tax Cuts and Jobs Act TCJA put in place. The deduction for state and local taxes is one of the largest expenditures in the tax code.

Tax deductions are a form of tax incentives along with exemptions and creditsThe difference between deductions exemptions and credits is that deductions and exemptions both reduce taxable income while credits. 52 rows The SALT deduction is only available if you itemize your deductions.

California Salt Cap Workaround Offered For Pass Through Entity Owners

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

Ca S Ab 150 Salt Cap Workaround For Grimbleby Coleman Cpas Modesto California

The Tax Cuts And Jobs Act Observations And Strategies After One Tax Season Marcum Llp Accountants And Advisors

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Salt Deduction Salt Deduction Taxedu

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

California S Workaround To The Federal Cap On State Tax Deductions Mgo

Maryland S Salt Workaround Impacts And Planning Opportunities Buchanan Ingersoll Rooney Pc

Eliminate The Salt Deduction Cap Get Your Questions Answered

Personal Finance Archives Spreadsheetsolving

House Dems Propose Lifting Salt Deduction Cap Amid Spending Debate Youtube

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Some Are Avoiding Salt Taxes Via Loopholes Youtube

Hidradenitis Suppurativa Healing Epsom Salt Bath Epsom Salt Bath Baking Soda Shampoo Foundation For Dry Skin